More than 30% of Catalan and Spanish retail spaces are closed or available. Of these, a part will be occupied at some point by commercial activity and the rest will be persistent closed or available retail spaces. In order to act and give them a final use, it is first necessary to be able to distinguish them. How do we do it?

First of all, you need to have data. Specifically, data from thousands and thousands of retail spaces in cities around the world, not just from Catalonia or Spain. All this “big data” is necessary to be able to understand the behavior of the commercial environment with solid indicators. How does the retail occupancy behave? What is the threshold of retail occupancy that marks desertification? When does the “domino effect” begin and retail stores start closing one after the other?

At the Eixos observatory we have been collecting data from retail spaces all over entire cities around the world, for more than 10 years.

An extensive network of geographic collaborators has visited, geolocated and classified hundreds of thousands of retail stores, on thousands of city streets around the world. Is the retail store at this address occupied or available? If it is occupied, what activity do we identify within it? We do this on a large scale, systematically and recurrently.

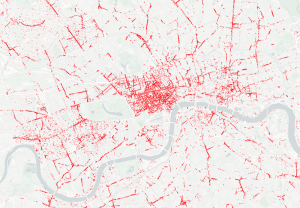

Map of commercial premises in London in 2020. Each red dot represents a visited and classified commercial premises, about 60,000 in total. The image covers an area of approximately 500 km2. Source: EIXOS Economic Observatory.

From these data, hundreds of economic indicators can be generated that allow us to say many things about the commercial and urban environment of the identified retail spaces. Once the data is available, the indicators tell us instantly what retail scenario the real estate asset is in.

Is it a commercially dynamic environment with good occupancy of retail spaces? Then we evaluate the commercial use of the retail space as viable. Depending on the retail health and commercial specialization, we can even recommend specific commercial activities that add value to the area’s offer. Are we in a scenario with severe desertification and systematic customer exodus to other areas? Then we will probably have to discard the commercial use of the retail space and give it a residential or some other type of use.

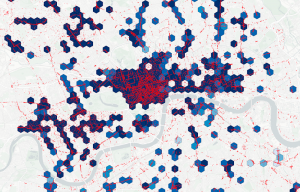

The Retail Occupancy Index allows us to say if the commercial environment of a place is healthy from an economic point of view. For example, if there are too many vacant retail spaces and there is commercial desertification (shutter effect).

Map of commercial occupation of London in 2020. Each hexagon represents a commercial area of 1/3 of a square kilometer, with at least 40 establishments inside it. The greater the intensity of blue, the greater percentage of commercial occupation. Source: EIXOS Economic Observatory.

The Destination Retail Indicator, on the other hand, allows us to say if there is a systematic customer exodus to other areas or if, on the contrary, there is sufficient commercial attraction.

With these two indicators, and with other complementary indicators, we have been able to develop a new massive real estate evaluation system for retail spaces. What is known as “scoring system”, adapted to the real estate sector or “real estate”. This has allowed us to rigorously and precisely analyze the real potential value and use of tens of thousands of real estate assets, based on the geographical commercial environment in which they are located.

This real estate scoring system is fully scalable, it is applicable to a single retail space, on a street scale, or twenty-thousand, on a city scale or a large property portfolio. When we created the system we did it taking into account the existing real estate asset evaluation systems. This new system is complementary and not substitutive.

The strategic objective of carrying out a real estate evaluation like this is always the same: to give a counterpoint to the asset price allocation system in the market, trying to counteract possible financial bubbles and giving solid arguments to both the seller and the buyer. The evaluation system allows for a safer and more reliable trading environment in the medium and long term.

One of the first results of creating this real estate scoring system has been to be able to quantify the loss of commercial assets as a result of the impact of the pandemic.

We will give a detailed overview of this in a future article.

David Nogué

Eixos.cat founder & CEO

twitter: @ddnogue e-mail: dnogue@eixos.cat https://www.linkedin.com/in/davidnogue/